The U.S. labor market, which has been booming since the pandemic recovery began, is showing signs of cooling, but the job landscape remains robust. According to the latest jobs report released in August 2024, employers added 142,000 new positions, a number that fell short of economists’ predictions. Although job creation is slowing down, the report reveals that the labor market is still healthy and wages are on an upward trajectory.

The report suggests that while hiring has shifted into a lower gear, concerns about a looming recession are unwarranted. Instead, the data points toward a gradual normalization, closer to pre-pandemic conditions. Economists like Sam Kuhn of Appcast are pointing out that the current trend is reminiscent of the 2019 labor market, a period of stability, rather than the tumultuous post-2008 recession era.

The latest figures show that while fewer jobs were added than anticipated, other indicators, such as wage growth and labor force participation, remain strong. The unemployment rate has slightly decreased to 4.2%, alleviating concerns raised in July when it spiked to 4.3%.

Job Growth and Revisions: A Shift in Momentum

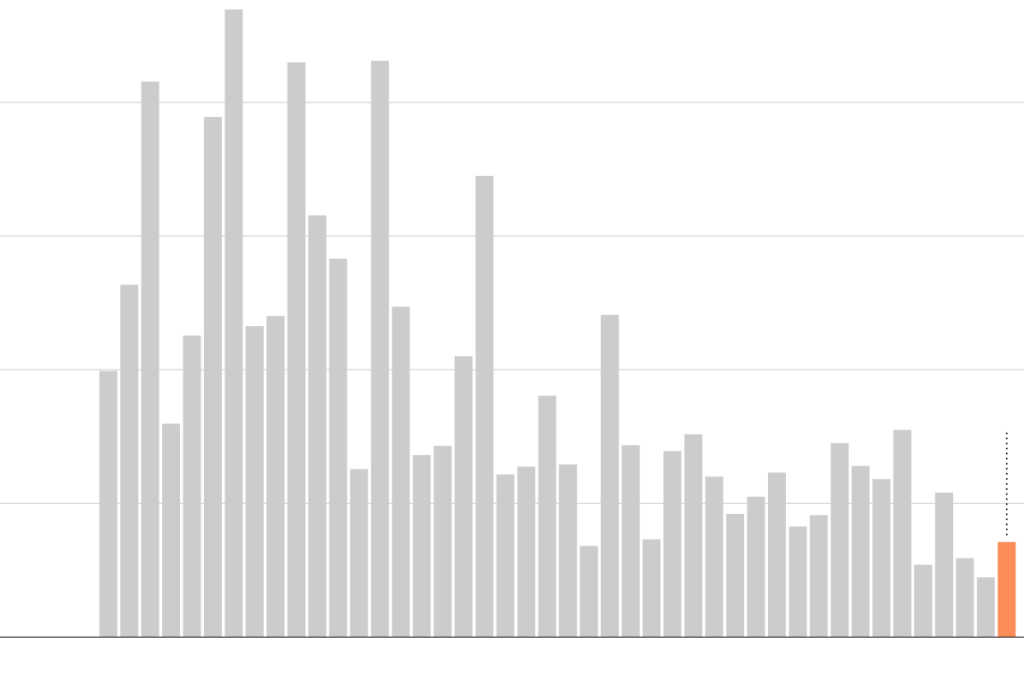

The headline figure of 142,000 jobs added in August, although positive, signals a slowdown. This shift is further underscored by the downward revisions of the previous two months, bringing the three-month average to 116,000 jobs. Compared to the monthly average of 220,000 jobs during the year leading up to June, this deceleration is stark.

Economists expect this trend to continue as part of an ongoing normalization in the labor market. The Labor Department’s revisions indicate that the labor market is treading water after experiencing an extraordinary period of expansion post-pandemic. That said, the new jobs added in August were largely concentrated in high-wage sectors like healthcare, construction, and hospitality—industries that continue to see steady demand for labor despite the overall cooling trend.

Wages and Workweek Hours: Signs of Stability

One of the more encouraging aspects of the August jobs report was wage growth. Average wages grew by 0.4% over the month, slightly exceeding economists’ expectations. This increase, although modest, suggests that inflationary pressures remain under control. The steady growth in wages, coupled with an uptick in the average workweek to 34.3 hours, indicates that businesses are maintaining stable employment levels, even if they are slowing down their hiring efforts.

The Federal Reserve has been closely monitoring wage growth as it evaluates its interest rate strategy. With wage increases moderate but steady, there is little risk of an inflationary spiral, which is why the Fed may soon begin to relax its current interest rate policy. Investors are betting on a quarter-point cut later this month, though the Fed’s decision could hinge on how the broader economy and labor market continue to evolve.

Sectors Driving Job Growth: Healthcare, Construction, and Hospitality

In August, a few key industries saw significant job creation, even as the overall labor market showed signs of cooling. Healthcare and related fields led the way, adding 44,000 new positions. The construction industry also showed surprising resilience, with 34,000 jobs added despite ongoing challenges posed by higher interest rates. Support for the construction industry has largely come from federal aid packages aimed at infrastructure, clean energy, and transportation projects.

For example, Rebecca Fountain, a Las Vegas-based construction firm owner, has seen a surge in government contracts related to these infrastructure initiatives. Despite concerns about an impending slowdown in private-sector construction, the influx of federally funded projects has kept her business humming. “We see there’s some kind of slowdown coming, and yet we’re getting all kinds of work now,” Fountain explained, highlighting the unpredictability in the sector.

The hospitality industry also made notable gains, particularly in food services and drinking establishments, which added 30,000 jobs. However, the industry’s recovery has been slow, with employment levels only recently surpassing pre-pandemic levels. Workers in this sector, like Justin Burgess, who works at a pizza restaurant in Seattle, continue to face challenges despite wage increases. Rising living costs and new policies—such as management deducting a percentage of tips to cover credit card fees—have left many workers feeling that wage growth hasn’t translated into improved living standards.

Unionized Labor and Skilled Worker Shortages

In sectors like construction, the demand for skilled workers remains high, and companies are struggling to find qualified labor. While unionized workers have traditionally been more accessible to employers like Rebecca Fountain, even union shops are now finding it challenging to fill certain roles. Surveys from industry groups like the Associated General Contractors and Arcoro reveal that firms across the board are facing labor shortages, particularly for positions that require advanced skills.

This shortage has led some employers to rely more heavily on recent immigrants, many of whom have been granted employment authorization shortly after arriving in the U.S. According to Adam Kamins of Moody’s Analytics, the influx of migrant workers has helped alleviate some of the pressure on industries facing labor shortages, particularly in sectors like agriculture and construction. This new wave of workers has allowed companies to maintain production levels without significantly driving up costs, which has been crucial in keeping inflation under control.

Manufacturing Weakness: A Drag on the Labor Market

While healthcare, construction, and hospitality are faring well, the manufacturing sector continues to struggle. Manufacturing has been largely stagnant since late 2022, with a notable contraction of 24,000 jobs in August. High interest rates and a strong dollar have taken their toll on new investments and exports, leading to a slowdown in production.

Timothy Fiore, chair of the Manufacturing Business Committee at the Institute for Supply Management, noted that many companies are running out of backlogged orders and are reluctant to make new investments given the current economic uncertainty. With the 2024 election looming, businesses are delaying large capital expenditures, waiting to see if the political landscape changes.

Labor Force Participation: Women Leading the Way

One bright spot in the August jobs report was the continued increase in labor force participation, particularly among women aged 25 to 54. In August, labor force participation for this group reached a record high of 78.4%. This is an encouraging sign, especially given the persistent challenges in the childcare sector, where employment has been declining since May.

For many women, re-entering the workforce has been crucial to keeping the labor market robust. Despite obstacles like expensive or inaccessible childcare, many women have returned to work, helping to balance out the overall decline in job growth. This growing labor force participation is one of the factors that has kept wage growth moderate while also preventing inflation from spiking.

The Bigger Picture: No Imminent Recession, But Slower Growth

Although the August jobs report shows that hiring has slowed, it doesn’t signal an impending recession. The U.S. economy continues to expand, with GDP growing at an annualized rate of 3% in the second quarter of 2024. Other indicators, such as consumer confidence, are also trending upward, suggesting that the broader economic outlook remains positive.

However, the cooling in the labor market is a clear sign that the post-pandemic recovery is entering a new phase. With job growth slowing and employers becoming more cautious about hiring, the focus has shifted to maintaining stability rather than rapid expansion. Wage growth, labor force participation, and the availability of new jobs will be key indicators to watch in the coming months.

Conclusion: A Slowing, but Stable Labor Market

The August jobs report reflects a labor market that has shifted into a slower, more sustainable pace. While hiring has decreased, the overall health of the labor market remains intact, with wage growth continuing and unemployment staying relatively low. The Federal Reserve’s next moves will be critical, as policymakers weigh the potential impact of a softening labor market against inflationary pressures.

As we move toward the end of 2024, the U.S. labor market appears to be entering a period of normalization after years of unprecedented growth and volatility. For many, especially those in high-demand industries, this shift offers stability. However, for workers in sectors like manufacturing, the slowdown may present new challenges. The coming months will reveal whether the current trends will continue, but for now, the U.S. economy remains on a steady, if slower, path forward.